Click to enlarge

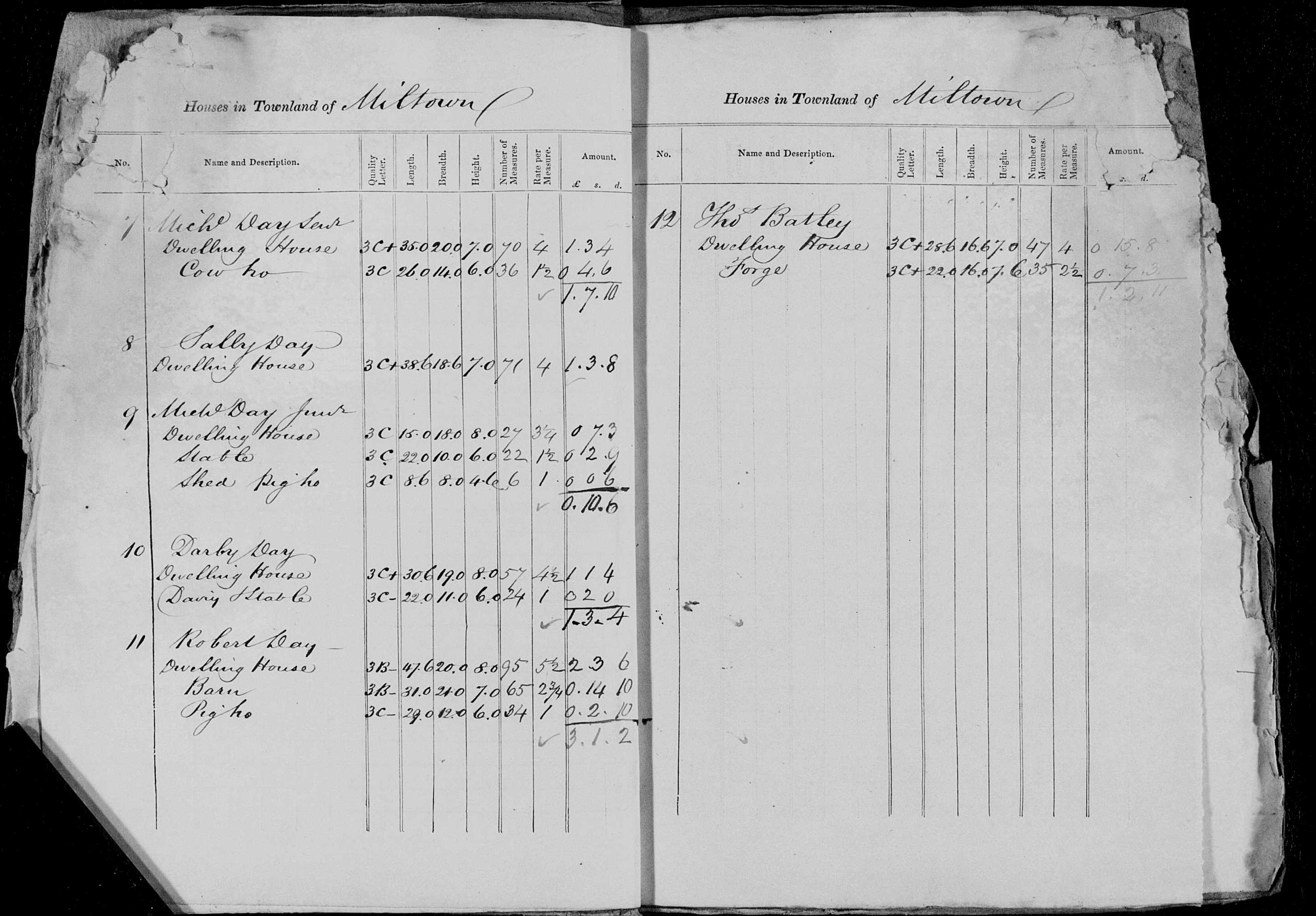

HOUSE VALUATION BOOKS

The first forms of taxation to raise money for poverty relief in Ireland date to the early eighteenth century, but it was only with the establishment of what became known as ‘Griffith’s Valuation’ during the middle of the nineteenth century that a comprehensive national system was established. This system was the first nationwide property tax designed to alleviate poverty in Ireland. It had its roots in the Irish Poor Law Act of 1838. Land and buildings were valued and then taxed at various rates. The money raised funded the workhouse system, the ancestor to the later public hospital system in Ireland. Boards of Poor Law Guardians were established locally to administer the system.

The House books record the dimensions of residences and outbuildings, length by breadth by height, and the condition of the buildings in terms of age, state of repair, nature of masonry, whether the roof thatched or slated, and so on. The terms used are house and then office, the latter in relation to any outbuildings. While this is generally the case in some instances the actual function of the out-buildings are recorded, such as for example stable or piggery. The name of the occupier is also recorded as is a lot number, in many cases but not always these lot numbers are the same as those in the published Griffiths. Where changes of occupancy have occurred during the period between the oldest workbook and publication these are recorded in the same way as is the case with the cancelled books, the old tenant’s name crossed out and the new one written above.

(Much thanks to Paul MacCotter's Genealogy and Family History Service for much of this information)